page 16

~ The Study of Threes ~

http://threesology.org

| Hybrids page 1 | Hybrids page 2 | Hybrids page 3 | Hybrids page 4 | Hybrids page 5 |

| Hybrids page 6 | Hybrids page 7 | Hybrids page 8 | Hybrids page 9 | Hybrids page 10 |

| Hybrids page 11 | Hybrids page 12 Playmate God |

Hybrids 13 Economics 1 |

Hybrids 14 Economics 2 |

Hybrids 15 Economics 3 |

| Hybrids 16 Economics 4 |

Hybrids 17 Economics 5 |

Hybrids 18 Economics 6 |

Hybrids 19 Economics 7 |

Hybrids 20 Language 1 |

| Hybrids 21 Language 2 |

Hybrids 22 Language 3 |

Hybrids 23 Language 4 |

Hybrids 24 Physics |

Hybrids 25 |

| Hybrids 26 | Hybrid 27 |

Visitors as of 30th July, 2021

Note: while we of today look backwards and see groups of three, this does not mean those in the past used an active sense of consciously doing so. However, one might well encounter tripartite ideas which eventually play out in some level of economics such as those of today who try to sell their interpretations of ancient philosophical ideas. However, when using Aristotle as a reference, some claim he spoke of a tripartite division such as: (The nutritive soul, The sensible soul, The rational soul) (The Three Types of Soul of Aristotle), or that he spoke of three sorts of substances: [Matter (potentiality), Form (actuality), The compound of matter and form] (Aristotle on the Soul, by Marc S. Choen). Yet, the following excerpt about the soul examines both Plato and Aristotle with respect to identifying Plato as having designed a Tripartite soul schema, and Aristotle insisting on a Bipartite division involving the dichotomy of the Rational/Irrational. It is an important distinction because we can see a "threes versus twos" orientation being used in economics theories, even if those studying economics are oblivious of the underlying philosophical and cognitive links to other subjects.

by Tiffany Harrington & Monte R. Johnson

Though humans mix and match numbers, there are only so many basic numbers. (Zero through nine.) Though humans may mix and match sex partners, the underlying basic formula is extremely limited, despite personal preferences for categorizing people according to some superficial attribution. The quantity of humans on the planet cause far too many to overlook the vulnerability being presented by the existence of a limiting basic design. The limited design of human biological substrates is cause for great concern, though too few have even considered to look in such a direction because at present it is not a fruitful occupation of time and energy with which to establish an income, reputation and overall self-defining livelihood. These tasks are pursued by way of collecting and hoarding valuable property such as real estate, desirable information, a marketable skill, valuable contacts and persuasiblity among leaderships, as well as some manner of currency... a currency which exhibits not only a hybridization of forms byway of its different denominations, but that the denominations are but few in quantity. For example, in the US of A there are only 6 types of metal coinage: pennies, nickels, dimes, quarters, fifty-cent and dollar pieces. With respect to paper bills we find seven: one's, two's, five's ten's, twenty's, fifties and hundreds, though different time periods or occasions there may be one or two others. (United States Currency; Large denominations of United States currency). If the six and seven were added to portray 13, some superstitious orientation might arise as it does in some elevators which do not possess the 13th floor as a designation. In other words, we again find the existence of an economic form of limitation in all currencies throughout the world, regardless of any rational which a reader might want to offer as a reason or excuse.

Specifically, we find that although there are around four thousand (plus) companies listed on the Stock Market (USA: Listed Companies), we find only a handful of the types of stocks (Types of Stocks). Please note the presence of singles, dichotomies and a triplicity:

Investing in the stock market has (from some perspectives when speaking of the history or stocks), been one of the most important pathways to financial success. Stocks are frequently discussed with reference to different categories classifications. However, the following arrangement uses a one (mono-tonomous [mono-autonomy]), two (di-tonomous [di-chotomous]), three (tri-tonomous [trichotomous ... or a 3-in-one ratio) arrangement. (And yes, I coined the words "monotonomous, ditonomous, tritonomous" so you won't find them in any conventional dictionary. They are hybrids.)

Monotonomous:

- IPO stocks (Initial Public Offering ["Mono-tonomous"] Category)

- Blue chip stocks/ Penny stocks (["Mono-tomonous"]Category based on perceptual judgments of quality.

- Safe stocks (Relatively stable stocks ["Mono-tomonous"] category)

Ditonomous:

- Common stock/ Preferred stock (Ditonomous Types of Ownership categorization)

- Domestic stock/

- International stocks (Ditonomous Categorization by way of location.)

- Growth stocks/ Value stocks (Ditonomous Categorization by risk and conservative ventures.)

- Cyclical stocks/ Non-cyclical stocks (Cyclical change [Ditonomous] category)

Tritonomous:

- E.S.G. stocks (Category emphasizing environmental, social, and governance concerns. (Can be viewed as a monotomony, tritomony, or 3 in 1 ratio representation.))

- Dividend stocks (also Income stocks)/ Non-dividend stocks/ (payment option categories; [Can be viewed as a Dichotomous or pseudo-trichotomy.])

- Large-cap stocks/ Mid-cap stocks- Small-cap stocks (Trichotomous Categorization based on the total worth of all shares.)

When we see companies being reduced to categories called stock market sectors, we find the following handful of companies (which remind me of the organelles of a cell, and in fact might be described as the organelles of a economy):

- Communication Services -- telephone, internet, media, and entertainment companies

- Consumer Discretionary -- retailers, Automakers, and hotel and restaurant companies

- Consumer Staples -- food, beverage, tobacco, and household and personal products companies

- Energy -- oil and gas exploration and production companies, pipeline providers, and gas station operators

- Financial -- banks, mortgage finance specialists, and insurance and brokerage companies

- Healthcare -- health insurers, drug and biotech companies, and medical device makers

- Industrial -- airline, aerospace and defense, construction, logistics, machinery, and railroad companies

- Materials -- mining, forest products, construction materials, packaging, and chemical companies

- Real Estate -- real estate investment trusts and real estate management and development companies

- Technology -- hardware, software, semiconductor, communications equipment, and IT services companies

- Utilities -- electric, natural gas, water, renewable energy, and multi-product utility companies

If not the organelles of an economic cell, then the particles of an economic atom. While one might stretch the analogy of economics with biology and physics to a point of incredulity, the generalized comparison is a useful one as a means of pointing out that micro- and macro-scales of activity are similarly conservative and represent different models of human conceptualization in different subjects. Adherents of one subject or another characteristically try to reduce, simplify and symbolize the information they are confronted with; thus providing a tell-tale sign about human consciousness, memorization, and resultant effects of being subjected to an incrementally deteriorating environment, including an increased population and reduction in resources.

By making lists, by categorizing, by thinking we have a much firmer grasp on larger amounts of information which may or may not be viewed as different types, we humans think we are being smart. But we seldom extend this smartness to view that this same type of mental behavior is taking place in all subjects, and that according to the human way of thinking, Nature itself practices a conservation... instead of considering that our activities, our views of nature in deciphering occurrences which appear to reveal a conserved quantity such as three laws of motion, three laws of planetary motion, etc., are all indicators that the human species is being subjected to an enforced measure of conservation as a survival mechanism under the conditions to which it is subjected.

Some readers might want to suggest the adage that a correlation can not be directly related to a causation, (typically phrased as Correlation does not imply causation); and often speaks to the quality of a single correlation being referenced. Yet if we add multiple correlations, we may well be provided with a hint that something IS a causal factor and that multiple correlations may well be pointing in the direction. Causation may create the presence for a give type or multiple expressions of different correlations to gravitate towards it. In this sense, we seldom recognize the possibility that a Causation may well cause the presence for a given type or multiple types of correlations to appear in its vicinity, like many a people gather in a crowd to see an accident, though they may not be the cause of the accident themselves as single players, yet collectively, they all contributed to the social scene in which a given Cause took place. For example, if a group of people did not frequent the usage of a Bank, a Bank may not have originated, whereby an individual trying to rob the bank would not have had the source to go about attempting to rob it. While the people are not directly involved with the robbery, one could claim they are indirectly responsible due to long-term social activities which cause a Bank to be developed.

We can use the presence of multiple correlations just as we do movement in water or hear some echo or feel some change in temperature or humidity. For example, if we see a cat atop a caved in metal roof, a knee-jerk reaction might be to blame the cat. Others might want to list the cat as an object with a given weight and that the presence of multiple cats may suggest a heavy object had dropped on the metal roof, unless the weight of multiple objects (cats or otherwise), caused a either a faulty construction to collapse or that the materials used in the construction were either of inferior quality or somehow got stressed beyond their standardized acceptable strengths created in an accepted method of production. In other words, correlations can be useful if we allow ourselves the latitude to reframe and rename the correlations to provide alternatively instructive efforts in our deductive reasoning that will be subjected to a rigorous testing method.

The point I want to make about Nature resorting to an activity of conservation in its activities of hibridization, is to present the idea that views concerning economics and the Stock Market are likewise to be met with some limitation, though economists have not yet created their own type of table from which to observe the presence or absence of a given stock market activity and thus understand what is taking place under given circumstances to produce a given type of hybrid. Because certain forces of Nature have to be present for the development of a given element or a given color, or a give electromagnetic degree, or a given temperature, or a given climate, or a given political movement, etc., the same goes for occurrences in the Stock Market and which economics perspective is being adopted. The stock market (and overall economics) is neither mystical, magical nor mythical, though some prefer to view it as if it were, so as to presumed to consider themselves some sort of wizard, warlock, witch, sorcerer, sorceress, high priest or high priestess with a one-of-a-kind visionary ability. The same was said for those who have a prodigious memory and can detect subtleties in nature and human behavior which escape the purview of most people indulging in everyday concerns which distract them from learning how to hone other skills of perception and conscious acknowledgment followed by an ability to take a responsibility for effecting that which will prove to be personally beneficial. The development of an element-like table for the stock market and overall economics will permit many more from taking advantage of opportunities which are presently being exploited by those who have learned to work without such a table being written out, but nonetheless have developed a working memory of... even if upon being asked to duplicate, would not know where to even begin illustrating... or would (deliberately or otherwise) provide misleading information because they do not want competition or are simply unable to adequately portray how they know what they know and in which way to use such.

Let us take for example: Wizards of Wall Street by Kirk Kazanjian. (Based upon interviews with a number of fund managers who are usually reclusive, this guide to investing on the stock market reveals how they beat the market using a range of covert techniques and strategies.) We should also list those of fictional characterizations since their abilities illustrate the human ability of some writers to exhibit the activity of conservation when creating their respective hybrid. Take for example: The Ten Greatest Wizards of All Time by R.K. Troughton. And some readers my like: (Unroman Romans) Warlocks and Wizards by Siobhán McElduff. Then again, let us not fail to list Thomas Edison as being described as the Wizard of Menlow park because of his repeated activities of producing technological ideas, though someone with uncommon abilities who engages in a sport does not typically warrant the title of being a wizard. Hence, wizardry, witchcraft, etc., have limitations of activities to be listed as being representative thereof. ( Thomas Edison: The Wizard of Menlo Park).

If I use such terms as the following in describing economic behavior, one easily surrenders to the view that multiple ideas can be associated to describe different activities and perceptions from different vantage points.

- Three Major types of economic systems: Traditional, Command, Market: )

- Traditional economies can have elements of capitalism, socialism, and communism. Traditional Economy With Its Characteristics, Pros, Cons, and Examples by Kimberly Amadeo

- Three basic economic questions needing to be answered by a society in order to meet the needs of its people:

(Three Economic Questions:

What, How, For Whom?)

- What should we produce?

- How should we produce it?

- For whom should we produce it?

- [Example of a three-to-one arrangement called a "four":

- Four main types of economic systems: traditional, command, market, mixed (also called a dual system involving market and command formulas): What is an Economic System?

- Traditional, Socialist/command, Capitalist/market, and a Mixed economy: ( Economic System Definition

- Five distinct types of economic systems: Traditional, Command, Centrally planned, Market, Mixed: Economic Systems: Definitions and 5 Types

Janus-faced (or Yin-Yang based) models related to Economics (counter-parts can be found in basic mathematics such as addition/subtraction, multiplication/division, imaginary/real numbers, squared/cubed [2 versus 3]). It should be noted that many of the ideas which can be viewed in terms of oppositional positions, are sometimes presented as a singular unit of activity just as the yin/yang ideas are said to be both positively complementary and complimentary, though positions and perspectives can be aligned to interpret the presence of negative contrasts depending on conditions that might otherwise produce and promote a viable and profitable symbiosis.

Let us look at some dichotomies occurring regularly in Economics, but not overlook that instead of a stated dichotomy in either an oppositional (Janus-faced) or complementary/complimentary Yin/Yang profile, the words "duality", two-pronged, double-forked, and their many corollaries need to be included since they also represent a similar mindset oriented in the same "two" or doubling direction which gives expression to a series or succession of two given ideas, reminiscent of the reduplication seen in infant babbling such as na-na, da-da, ba-ba, etc. and followed later on by early speech patterns with a characteristic two-patterned profile such as no-no, up-up, doggy-sit, etc., though three types of babbling are identified in this article (which is not using the word "transition" to identify changes in cognitive development and thus cognitive profiling): (What is Babbling?)

- Marginal Babbling: This babbling usually happens between 4-6 months of age. You will hear your infant put together consonant-vowel (CV) or vowel-consonant (VC) sound combinations, like "baaaa", "maaaa", or "uuuum."

- Reduplicated Babbling: This refers to when your infant repeats the same syllable over and over, such as "babababa" or "mamamama" or "gagagagaga".

- Nonreduplicated Babbling: In this final stage of babbling, your infant's sounds are now more varied. Rather than producing the same syllable over and over, he will now start to combine different sounds and syllables like "bama" or "gagameee".

- 6 Early Theories About the Origin of Language by Arika Okrent, Decenber 3, 2021

- Evolution from recapitulation theory to Neural Darwinism by JMS Pearce (H.O.B. note: Haeckel's phrase "Ontogeny recapitulate Phylogeny" has been restated to "Embryonic ontogeny recapitulates Embryonic phylogeny". In other words, his macrocosmic application has been reduced to a microscopic reference, though his original phrase is used by many to refute his claim altogether, even though without his assertions the refutations might not have even originated, nor influence the many researchers who have made great strides in developmental biology.)

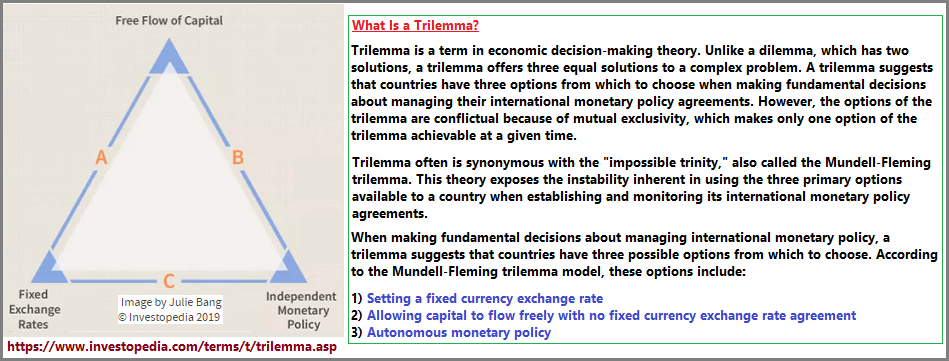

In short, we are witnessing a recurrence of a mental activity in Economic theory (as well as mathematics and other subjects such as the Legal Doublets), which describes the presence of a mental limit (for the species being represented in various professions); prior to the hopefully eventual gain of further cognitive development, unless there is something in the environment and or diet and or genetics, which prevents moving forward. And let us contrast this acknowledgement of the "two-profile" with the sparse usage of tripartite ideas being presented as models such as: The Trilemma (The Trilemma–(exchange rates, capital flows, and monetary policy) The 50 Most Important Economic Theories), as well as the abundance of singular idea economic models (which often consist of multiple variables) and the lack of models in which there appears to be no distinctive models expressing enumerations with four, five, six, etc., components as do the dichotomies and the trichotomy. Simply put, there are not many stated "Tri-configured" economics models.

Another "three" found in Economics is the "Third Way" idea: (Economics A-Z terms beginning with T)

Third way– An economic philosophy espoused by some leftish political leaders in the late 20th century, including Bill Clinton and Tony Blair. According to the rhetoric, it is not CAPITALISM and not SOCIALISM, but a third (pragmatic) way. Many have therefore found it rather hard to pin down. It was earlier used to describe Sweden’s economic model.

Like mathematics, there is an over-riding reliance on dichotomies... suggesting a cognitive stop like the development of number concepts which expressed limitations. If ever humanity needed a revolution, we need one to occur in the thinking of Economics, as well as mathematics, architecture, music, biology, physics, philosophy, literature, etc...

- Economics as a science versus Economics as effective theory (

How Effective is Economic Theory? by Arnold Kling, Summer 2017)

- Mathematical rigor versus Mathematical relevance with respect to applied economic theory

- Empirical versus Theoretical (What is an Economic Model? by Jess)

- Economics: Methods, approaches, fields and relevant questions

- Normative vs. Positive

- Theoretical vs. Applied (focus)

- Theoretical vs. Empirical (techniques)

- Categories of Empirical approaches

- "Causal" vs. "Descriptive"

- Structural vs. Reduced Form

- Quantitative vs. qualitative (the latter is rare in economics)

Here are some "two-profile" ideas which do not readily portray the obvious dichotomization of some of the previous examples: (Understanding Economics)

- economics is about the study of scarcity and choice

- economics finds ways of reconciling unlimited wants with limited resources

- economics explains the problems of living in communities in terms of the underlying resource costs and consumer benefits

- economics is about the co-ordination of activities which result from specialisation

The following examples remind me of Sir Frances Bacon's "Idols" categories, one of which specifies "Idols of the Marketplace" or Idola fori:

Idola fori (singular Idolum fori), sometimes translated as "Idols of the Market Place" or "Idols of the Forum", are a category of logical fallacy which results from the imperfect correspondences between the word definitions in human languages, and the real things in nature which these words represent. The term was coined in Latin by Sir Francis Bacon and used in his Novum Organum, one of the earliest treatises arguing the case for the logic and method of modern science.

Indeed, business often entails the usage of imagination to sell and purchase a given commodity, thus what one person claims to be one thing may be actually another and that which is being sold may not be realized by the seller as an opportunity to make a larger investment by a purchaser who makes claims or gives the impression of making a purchase for reason but actually has one or more ulterior motivations. The marketplace is a forum in which all types of subjects and ideas can play-out different roles and rationales. Hence, let me label a handful:

- Theater of the marketplace (or the Theater marketplace)

- Drama of the marketplace (or the Drama marketplace)

- Mechanics of the marketplace (or the Mechanisms marketplace)

- Psychology of the marketplace (etc.)

- Philosophy of the marketplace (etc.)

- The Information marketplace. (etc.)

- The Job Market...place.

- The Higher Education marketplace.

- The Marketplace for a political career.

- Sociology (or social trends) of the marketplace (etc.)

- Physics of the marketplace (etc.)

- Metaphysics (philosophy) of the marketplace (etc.)

- Architecture of the marketplace (etc.) (The Architectural marketplace)

- S.O.P. (standard operating procedure) of the marketplace (etc.)

- Astrology of the marketplace (etc.)

- Astronomy (constellations) of the marketplace (etc.)

- Inequities of the marketplace (etc.)

- Circus performers (and performances) of the marketplace (etc.)

- Sleight-of-hand maneuvers of the marketplace (etc.)

- Corrections Institutions marketplace (A marketplace for enhancing criminal knowledge to developed into skills.)

- Legalized gamblings (and sometimes criminalities) of the marketplace

- Addendums to the Marketplace labeling: (Voodoo economics, Reagan Economics, etc.)

- 4 Models of the Marketplace used in economic analysis: (visual models, mathematical models, empirical models, and simulation models) Economic Models

- 4 key economic concepts marketplace: (scarcity, supply and demand, costs and benefits, and incentives) 4 Economic Concepts Consumers Need to Know by Andrew Beattie

- etc...

Date of (series) Origination: Friday, 30th July, 2021... 6:38 AM

Date of (this page's) Initial Posting: Thursday, 18th November, 2021... 10:29 AM

update: Thursday, 3rd December, 2021... 1:22 pM