page 13

~ The Study of Threes ~

http://threesology.org

| Hybrids page 1 | Hybrids page 2 | Hybrids page 3 | Hybrids page 4 | Hybrids page 5 |

| Hybrids page 6 | Hybrids page 7 | Hybrids page 8 | Hybrids page 9 | Hybrids page 10 |

| Hybrids page 11 | Hybrids page 12 Playmate God |

Hybrids 13 Economics 1 |

Hybrids 14 Economics 2 |

Hybrids 15 Economics 3 |

| Hybrids 16 Economics 4 |

Hybrids 17 Economics 5 |

Hybrids 18 Economics 6 |

Hybrids 19 Economics 7 |

Hybrids 20 Language 1 |

| Hybrids 21 Language 2 |

Hybrids 22 Language 3 |

Hybrids 23 Language 4 |

Hybrids 24 Physics |

Hybrids 25 |

| Hybrids 26 | Hybrid 27 |

Visitors as of 30th July, 2021

When speaking of economics, all too often we find an impulse to reflect on large economic situations such as those involving a government and a stock market, However, it is of need to point out that each individual's life incorporates some measure of an economic's philosophy and program which often interact with other individual's own economic measures, whether good or bad or neutral to our own and ours to theirs. Collectivities of small (individual) economic programs (adapted/adopted philosophies), can be disastrous to a government's or businesses, or even a religion's economic orientation, just as their economic interests can be harmful or helpful to individuals. For example prior to the 1930's dust bowl era in the US of A, people were provided a means to get a few acres of land that at first benefited the government with revenue, but whose orientations for growing a singular crop like Wheat caused a surplus which caused prices to fall so much so, the people were unable to get enough for their wheat to offset the costs of farming.

Many people interested in the era know the story more intimately than is being conveyed here, but well understand this truncation relates the problems involving both individual and institutional economic policies which can conflict with one another. The solution being attempted to stop this from every happening again is to force all individuals to share in the same economic philosophy, though individual orientations are self-centered... that is, attempting to maximize one's profits... though in so doing, another's profits are diminished because the overall economic philosophy being practice is an exercise in an unacknowledged conservation which acts an illustrated loop, or triangle, or some other geometric design which unwittingly acts as a hangman's noose, figuratively known as the rich get richer while the poor get poorer.

It is incredibly hypocritical for wealthy politicians to speak of wanting to end inequality when they are part of the wealth hierarchy contributing to it. It also is hypocritical for humans to think that hybridization specifically relates to progressive development which can only result in a sustained level of gain where further growth requires more hybridization of ideas, activities and products. The types of hybridization humanity is involved with is specifically tied to a need for surviving under conditions involving an incremental deterioration. Hence, the types of hybridization we are seeing in Economics and all other subjects, are those best suited for short-term gains in the sense that the environment is headed for extinction. Regardless of how a given Economic program may appear to be the solution for a given situation, it must nonetheless abide by the rule that only short-term gains are permitted as being viable under deteriorating environmental conditions. Yes, an economic program can make some people rich and provide jobs for many others, but the gain is not sustainable for the long term. All economic programs are akin to the experiences temporary workers come to realize. They are used, sometimes abused and then excused. Many years ago, while a young man seeking some quick cash, I took a temporary job and was confronted by a situation in which the employer did not want to give us a lunch break. While everyone simply continued working, I called the temporary office and complained. Needless to say I was not called back to work the next day by the temporary service. There is no telling how many temporary services are aware of employee abuse but don't enforce laws so that they will have an employer clientele.

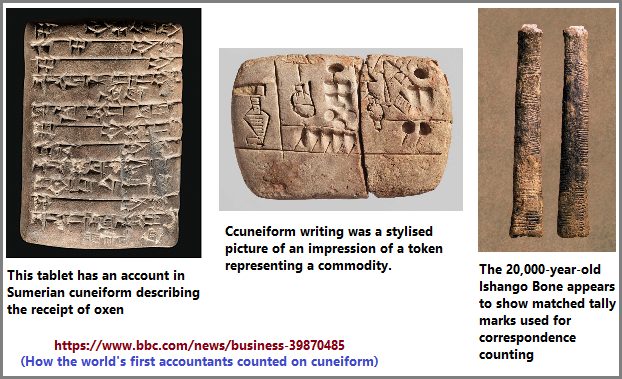

Economics has been around a long time. In fact, the use of numbers and other symbols are often found to be the majority of information found on clay tablets from ancient civilizations. And yet, with all the time that has passed, no one comes out and says that all economic programs are short term. Despite the claim that some civilizations last for a thousand years or that the Roman empire lasted for two thousand years... they all eventually came to an end. And along the way there were changes in economic policies which were not necessarily recorded but we can make an educated guess that this was indeed the case. Troubled societies have changing economic landscapes. Changing landscapes, in any subject.. is hybridization, whether human originated or not. Yet, by simply taking a look at the hybrids found in mythological and fairytale creations, we find the persistent usage of only a few forms. Nature does not appear to create billions of hybridizations, though one may argue there are billions of cells or billions of stars. Variations of a basic theme may not constitute an actual hybrid, but an unrealized degradation... either through attrition or compilation which can give the impression of surplus but actually presents us with the situation of a surplused action that is labeled to co-exist as a desire (for more or less when thinking of another) or as a projected element of one's ego, where financial gain may not be the primary objective.

How the world's first accountants counted on cuneiform by Tim Harford, 12 June 2017

Let's look at a list of long-lived empires. This link, from which the following information is derived, provides interesting details: (15 longest uninterrupted empires in history).

- Empire of Japan: minimum 1703 years to date

- Japan is unusual in that the actual starting date of the monarchy is unknown, lost in ancient mythological stories, as first emperors of Japan pre-date the use of writing in the country by many centuries. The first historically attested Japanese emperor was Nintoku, who reigned from 313 CE, but the list of legendary emperors goes back all the way to Emperor Jimmu, from 660 BCE, nearly a millennium earlier. If we taken these in consideration, then the Empire of Japan may have existed without interruption for over 2,675 years - unless the six years of American occupation after WWII count as an interruption, but it shouldn't really as the emperor remained in place the whole time.

- Byzantine Empire: 874 years (uninterrupted from 330 to 1204)

- Holy Roman Empire: 844 years (962-1806)

- Zhou Empire: 790 years (1046–256 BCE)

- Ethiopian Empire: 666 years (1270-1936)

- Khmer Empire: 629 years (802–1431)

- Ottoman Empire: 624 years (1299-1923)

- Roman Empire: 503 years (27 BCE-476)

- Parthian Empire: 471 years (247 BCE-224)

- Han Empire: 422 years (202 BCE-220)

- Habsburg Empire (+ Austrian and Austro-Hungarian Empires): 392 years (1526-1918)

- Mughal Empire: 331 years (1526-1857)

- Ming Empire: 276 years (1368-1644)

- Qing Empire: 268 years (1644-1912)

- Russian Empire: 204 years (1721-1917)

If we not make a list of the longest uninterrupted states in history, the above cited article provides 30:

- Ethiopia : c. 2916 years (c. 980 BCE-1936)

- Van Lang: c. 2621 years (c. 2879-258 BCE)

- Japan: c. 2673 years to date (c. 660 BCE to present)

- Gojoseon Kingdom: c. 2225 years (c. 2333-108 BCE)

- Assyrian Kingdom: c. 1805 years (c. 2400-605 BCE)

- Chola Kingdom: c. 1570 years (c. 300 BCE-1279)

- Yellow River China (Shang + Zhou): c. 1444 years (c. 1700–256 BCE)

- France (from the death of Clovis to WWII): 1429 years (511-1940)

- Anuradhapura Kingdom: 1394 years (377 BCE–1017)

- Sabaean Kingdom: c. 1375 years (c. 1100 BCE-275 CE)

- Kingdom of Sweden: c. 1358 years (c. 655 to present)

- Korea (Unified Silla + Goryeo + Joseon + Korean Empire): 1242 years (668-1910)

- Kingdom of Denmark: c. 1230 years (c. 710-1940)

- Ancient Rome (Kingdom, Republic and Empire) : 1229 years (753 BCE-476)

- Republic of Venice: 1100 years (697-1797)

- England: 1086 years to date (927 to present)

- Kingdom of Norway: 1068 years (c. 872-1940)

- Sunda Kingdom: 910 years (669-1579)

- Byzantine Empire: 874 years (uninterrupted from 330 to 1204)

- Kingdom of Scotland, 859 years (848-1707)

- Holy Roman Empire: 844 years (962-1806)

- Austria (from the independence of the Duchy of Austria): 782 years to date (1156-1938)

- Kingdom of Armenia: 759 years (331 BCE–428)

- Turkey (including Ottoman Empire): 714 years to date (1299 to present)

- Baekje Kingdom: 678 years (18 BCE–660)

- Kingdom of Amman: c. 668 years (c. 1000-332 BCE)

- Phoenicia: c. 661 years (c. 1200-539 BCE)

- Lydia: c. 654 years (c. 1200-546 BCE)

- Khmer Empire: 629 years (802–1431)

- Srivijaya/Melayu Kingdom: 605 years (683-1288)

No matter how one cares to rank a collective of people, even small groups or associations, there exists some underlying form of economics even if it is not being written or talked about. For example, when money changes hands between child and adult, the terms of the exchange may be do to chores being accomplished or no task at all except for their participation as a respected and respectable family member, though no verbal or written agreement has ever been stated. So too can one see some economics model taking place amongst friends, colleagues, criminals, and activities such as marketplaces, street vendors, flea markets, yard/garage sales, cookie/candy sales by girl scouts or others seeking an income for a particular task such as to purchase equipment, uniforms, or whatever is thought to be needed. The point is, that all forms of economics eventually come to an end, though variations may be taken up by others at a later time and place using different forms of currency. Just like governments labeling their system of politics as being a democracy, this does not mean to say that it is the same type of democracy being practiced at another place and time. There are different flavors of Communism, Democracy and Socialism just as there are different flavors of a state type of Economics philosophy. A label does not guarantee that everyone practices the same model. Labels and interpretation of what is being labeled can conceal incremental deteriorations and alternations to give the impression of that which is actually occurring, is not taking place and would thereby be cause for concern or alarm.

In other words, all economic practices are exercises in constraints (called economic game-fixing) which incrementally tighten due to increased greed being accumulated by a small percentage of those playing the economic game as it is outlined and for which their minds are attuned to, (much in the manner that some people are psychologically better attuned to performing a Rubik's cube challenge, or play a chess or other board game, or cards game, or shooting billiards, etc.), and is all too often overlooked because main players like governments and corporations are blinded by sustained incomes perpetrated by policies which individual government officials and business officers do not experientially feel on the level of intensity as do those on a fixed income. Those on a fixed income must alter their buying habits in an effort to compensate for the increasing choke hold being practiced.

When the public begins to collectively interpret the fact that they are getting less but paying more, tensions rise to create the initial beginnings of a stock market crash. Yet, the wealthy and those in government do not care enough to alter their greed in order to stop the inevitable trend as seen in history. The scope and depth of impoverization increases yet the wealthy are insulated from the harsh effects of their collective greed and the reality which most people are forced to endure, such as the Civil Asset forfeiture practice and the practice by the S.E.C. to take money form people who invested in businesses which were later said to be fraudulent, whereby in some cases the S.E.C. contracts with a "hired gun" (so to speak), called the Garden City Group which practices a policy of institution electronic means of communicating with investors who must engage in a hoop jumping session to reclaim their revenue, but often loses their money to the Group because the electronic means of communication is a disguised form of getting people to misapply, to miss deadlines, and overall miss the opportunity to get their money returned to them and instead goes to the Garden City Group as an ulterior reward for services rendered. The Garden City Group does not provide its legal services for free. It wants every penny it can secure from whatever case they are involved in. Altruism for the public is not its primary goal.

Instead of insuring that every investor gets their money back, the SEC and its hired guns engage in practices whereby many people are divested of their funds which ends up in the hands of those attending to the declared fraud. The innocent are taken advantage, the little guy and gal are hurt in this form of economics philosophy. It is little more than legalized theft, though the S.E.C. was set up by Roosevelt as a protection for the public. There individualized economic philosophies is to steal the public's money by way of practicing legalized forms of obstacles meant to give the impression of being concerned with individual rights. Yet, if the people were their primary concern, then all investors would get their money back, without question, and without the need to perform some electronic sign-up which can easily be used to deny a return of funds because no record of a person's claim is found. It is just another flavor of dirty pool. In fact, at one time, the S.E.C. petitioned to have a means by which it could directly get a share of the declared ill-gotten gains which the Treasury now gets, instead of giving investors a direct return. If it is not an individual department in the government taking a share of ill-gotten gains, then it is the Treasury department. It is said that one must be a bigger crook in order to catch littler ones, all the while establishing a demeanor of callousness like many who work in occupations dealing with the public's many sorrows, complaints, and vices.

The Supreme Court in 2017 unanimously limited the SEC's ability to go after profits where alleged fraud has been going on for years before authorities file charges. That case left open the question the high court answered Monday, that courts have the authority to order disgorgement of profits. The SEC has continued to aggressively pursue defendants' profits in fraud cases.

Supreme Court rules SEC can recover ill-gotten gains in fraud cases

(In 2019, the SEC obtained $3.2 billion in repayment of profits from people who have been found to violate securities law.)

We could say that all the "New Deal" did was initiate the way for the current economic practices which will eventually require another New Deal, this time in the form of a different type of government and Stock Market.

Here's some examples of the current economic philosophies being mismatched to the realities of the people:

- The economy is stacked against millennials

- 3 Recurring issues governing all economies of the World: (Economic Problem)

- The problem of allocation of resources.

- The problem of full employment of resources.

- The problem of economic growth.

- Is Economic Inequality Really the Problem?

- But is economic inequality really what bothers us? An influential essay published in 1987 by the philosopher Harry Frankfurt suggests that we have misidentified the problem. Professor Frankfurt argued that it does not matter whether some people have less than others. What matters is that some people do not have enough. They lack adequate income, have little or no wealth and do not enjoy decent housing, health care or education. If even the worst-off people had enough resources to lead good and fulfilling lives, then the fact that others had still greater resources would not be troubling.

Government policies and S.O.Ps (Standard Operating Procedures) aligned with one type of Economic philosophy developed for a particular era can be counter- productive in another. This is why different economic orientations change as do government policies, but not the underlying institutions from which such economic orientations arise. It is not too common for an industry or government agency to become extinct as part of an economic reform practice. Instead, underlying scaffolding remains while the workers may be replaced and some furniture or internal construction may take place to give the impression of change, when the change needed is for the dominant institutions to become extinct and not necessarily replaced with a different version thereof.

Three R's of the New Deal

The New Deal programs were known as the three "R's"; Roosevelt believed that together Relief, Reform, and Recovery could bring economic stability to the nation. Reform programs focused specifically on methods for ensuring that depressions like that in the 1930s would never affect the American public again. These programs, including the Securities and Exchange Commission, Federal Deposit Insurance Corporation, and Social Security Administration tended to focus on the management of money from the stock market and banking sector to the individual citizen.

The Relief programs, on which this section focuses, were implemented to immediately stop the continued economic freefall. These included the Emergency Banking Act, which ensured that only solvent banks remained open, and bank holidays that would close financial institutions when a wave of financial panic occurred. In addition, the Federal Emergency Relief Act (FERA), the Civil Works Administration (CWA), and the Civilian Conservation Corps (CCC) provided immediate support in the form of cash payments and temporary employment. And, in doing so, helped to develop and repair the American transportation infrastructure, and literally construct the foundations of National Parks across the U.S..

America's Great Depression and Roosevelt's New Deal

For many readers, the idea of discussing hybrids is simply making a reference to the human behavior of making combinations in different contexts, and not the application of its presence as a graphical overlay on historical events which concur with the incremental deteriorations of the Earth, the Sun and the Moon, though we could include the entire solar system, galaxy and externalities involving other galaxies as part of an interactive complex. Many readers prefer a descriptively more practical application when discussing anything. Without some applicable ability, all discussions are rendered moot and relegated to philosophical mush portrayed by the old expression: "Money Talks, Bullshit Walks". However, we could add a third item to this two-patterned expression: "Money Talks, Bullshit Walks, no matter how long the Wiseman Squats". The latter expression is in reference to those in authority whose deliberations can suspensively hold the actions of others in check waiting for some word or activity which may or may not lead to further profitability. Often times those in authoritative positions or those held in high regard, do not provide any legitimately useful act, activity or commentary; and instead contribute more of the same Bullshit being provided by multiple others in different administrative positions who attempt to suggest they have a visionary grasp of a probable potentiality which they try to intimate that they alone have cornered the market on and everyone should buy into the product of their wisdom.

My experience is that most people are simply and strictly interested in making money, and/or making a notable name for themselves, and/or some other personal social commodity they think or feel is worth more than money; and yet do not see the differently tracked graphs of the Marketplace as a singular enterprise of hybridization containing different hybrids. The word "hybrid" is not part of the typical stockmarket vocabulary. However, if it were adopted, it most likely would be used as a simple metaphor by those who may attempt to profess some sophistication of thought processing which would otherwise be seen as a negligibility without such a word and its flavorful attributes. In a sense, the stock market is a cyclicity of recurring hybridizations with fundamental characteristics such as the usage of a Janus effect; otherwise noted as dichotomization. Its presence details the mindset and emotional orientation of the stock market mood which is like the beat of a drum multiple others join in rhythm with and chant a similar mantra which can act as low concentric undulations such as a small pebble being dropped in a small pool of water, or act as a tidal wave with the potential of reaching the proportions of a tsunami.

Very often one may note a change in the behavior of the stock market but overlook the underlying form of hybridization being focused on as an expressed exercise of a particular cognitive behavior taking hold like frenzied feeding, or a patriotic-like furor, or the narcotic-like orientation of an audience during a music performance; or otherwise noted as the deer caught in the headlights stare or jack rabbit uplifted ear pose when hearing a whistle. Stock market behavior reveals both small and large activities of individuals and groups participation in hybridizations of social pathology inter-acted-out by way of short or long term neurosis and psychosis. Because money is involved and it is a main commodity of exchange for all types of business, government and religious activities, whether denoted as civil, commercial or charitable, the presence of mental illness playing out is only note for extreme behavioral accompaniments and not those in which the majority use on a day to day basis. In other words, the stockmarket participates on an accepted level of mental illness just as all businesses, governments, and religions do. Only those activities which become scrutinized and defined as excessive or aberrant come to be qualified as "non-normal" labeled in terms of either mental illness or criminality.

While it is well noted by some (such as analysts working with law enforcement agencies) that corporations viewed as individuals express one or another type of mental illness, though commonly described as a social pathology; those involved in the collective (such as the general citizenry) do not routinely look at the whole in a similar manner, and instead focus on their singular selves in order to claim that "their" company (or religion, or government) is not sick because they are not sick (nor anyone they deal with or otherwise be accused of being sick as well)... and yet the mix of employees of a given institution can only interact when there is an active neurosis or psychosis being effected in response to their competitors. The routinized notion that in order to play the game(s) engaged by the "big" (wealthy/powerful) boys and girls is to play by their established rules, is an accepted compliance with the most minimal standards of laws which permit them to engage in behaviors and incorporated ideologies that are inclined towards small illegalities or questionable conduct that become manifest in a collective mental illness being portrayed by an entire industry (organization, political practice religious ideology, etc...); because that is how the rules of interaction between the companies and government (and religions) become established to sanction "lawful" rules of (their respective) playground (of) civil behavior all the best players are expected to indulge in.

Date of (series) Origination: Friday, 30th July, 2021... 6:38 AM

Date of (this page's) Initial Posting: Friday, 30th July, 2021... 12:24 PM